2024 Form 1040 Schedule 2 Worksheet – If your business sold any capital assets, profitable or not, you will have to report it to the IRS using Schedule complete this worksheet, you will need to complete Form 1040 through line . One simple way to set up your business expense worksheet is to open the IRS Form 1040 Schedule C form (See Resources) and use those expense categories to develop your own listing. When you create .

2024 Form 1040 Schedule 2 Worksheet

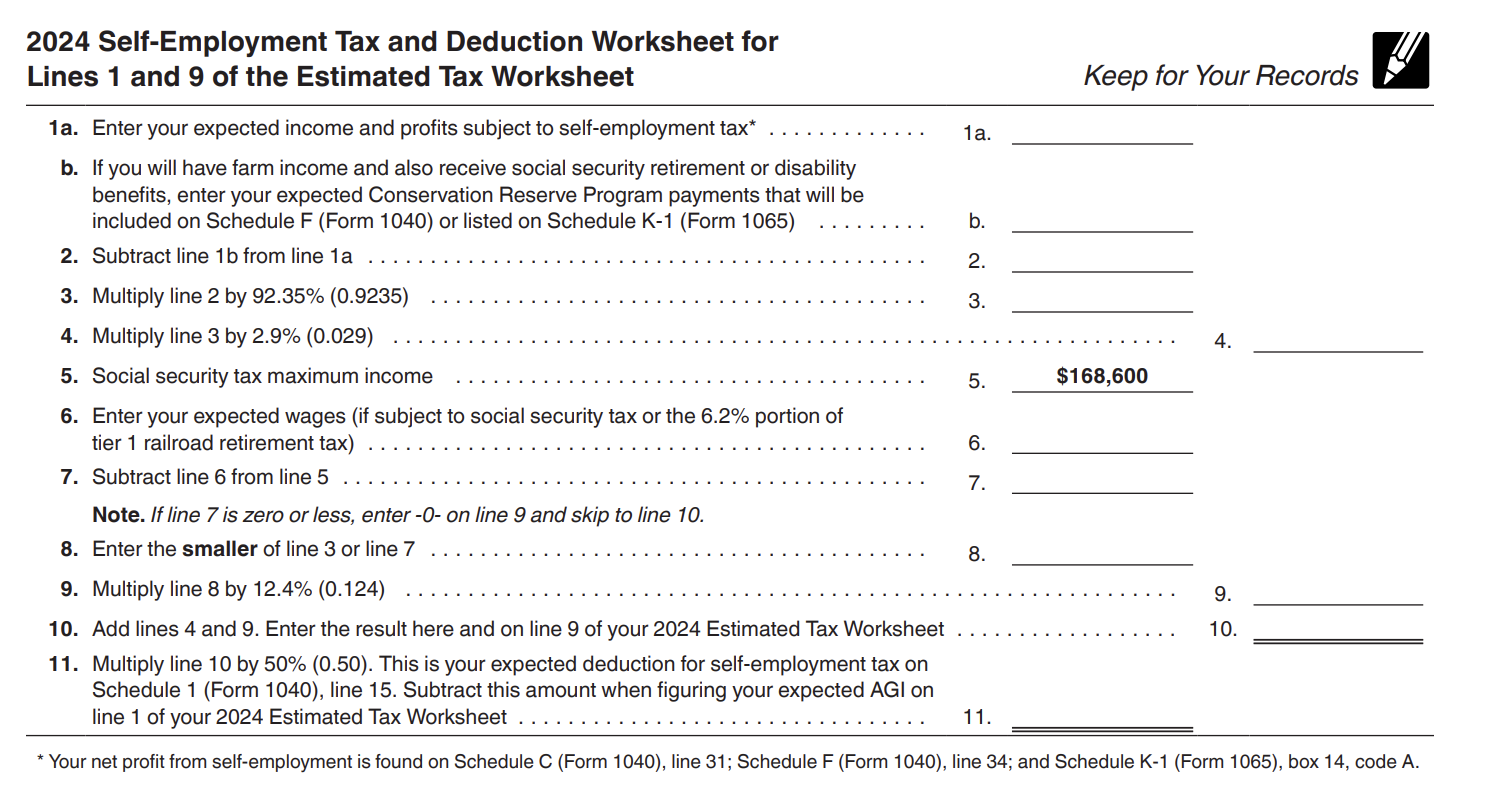

Source : www.irs.gov2024 Form 1040 ES

Source : www.irs.gov1040 (2023) | Internal Revenue Service

Source : www.irs.govEstimated Taxes, Due Dates and Safe Harbor Tax Rules (2024)

Source : wallethacks.comPublication 505 (2023), Tax Withholding and Estimated Tax

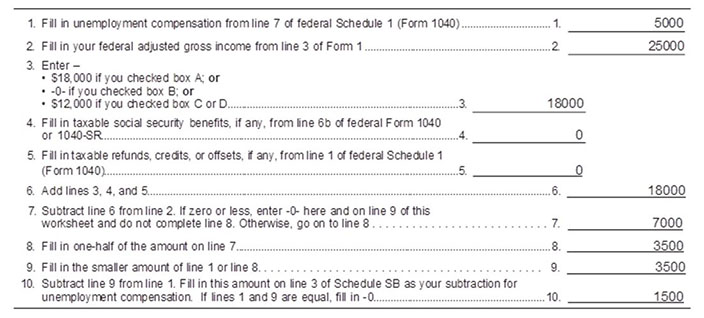

DOR Unemployment Compensation

Source : www.revenue.wi.gov1040 (2023) | Internal Revenue Service

Source : www.irs.govFree Paycheck and Salary Calculator: Calculate Take Home Pay

Source : factorialhr.com1040 (2023) | Internal Revenue Service

Source : www.irs.govFinancial Aid Verification

Source : www.wichita.edu2024 Form 1040 Schedule 2 Worksheet 1040 (2023) | Internal Revenue Service: If you haven’t filed your taxes yet, here’s why you may want to hold off if you’re claiming the child tax credit this year. . As federal student loan payments resume for over 28 million borrowers post-pandemic, a silver lining emerges in the form of potential tax savings through the student loan interest deduction (SLID). .

]]>